by Teresa Leung | Mar 11, 2017 | Blog

As investors, one of the first things we should look into when choosing where to purchase income properties is the economic fundamentals of an area. Does the area have a strong population growth? How is the job growth in the region? Are vacancy rates high or low?

BC currently shows a strong population growth, job growth and low vacancy rate. Here are some excerpts from the CHMC Vancouver Housing Update and Urban Analytics Futurecast presentations which we can use to determine where to purchase next.

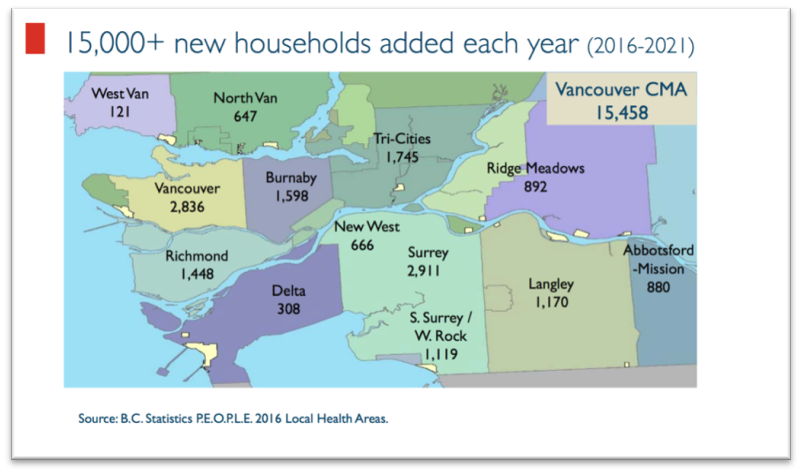

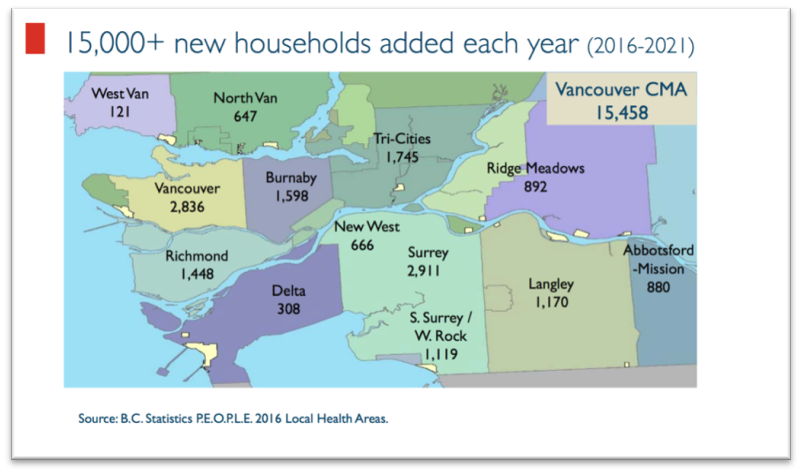

Surrey lead BC’s population growth, adding 4000 households, while Vancouver was second with 2836 new households.

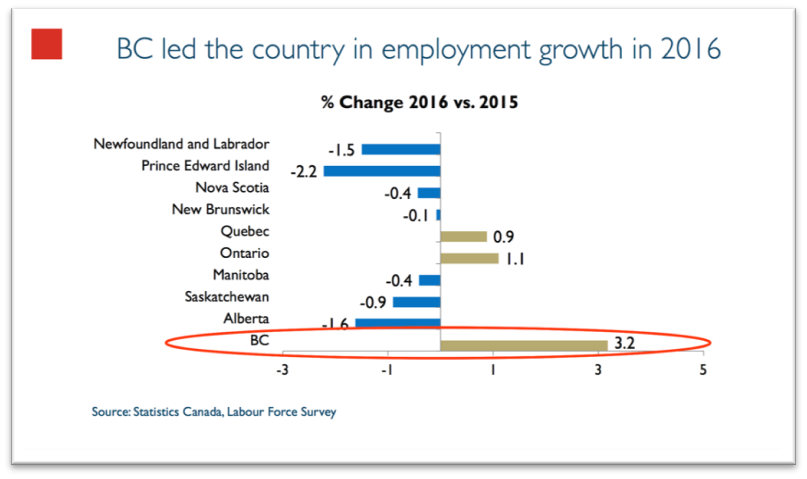

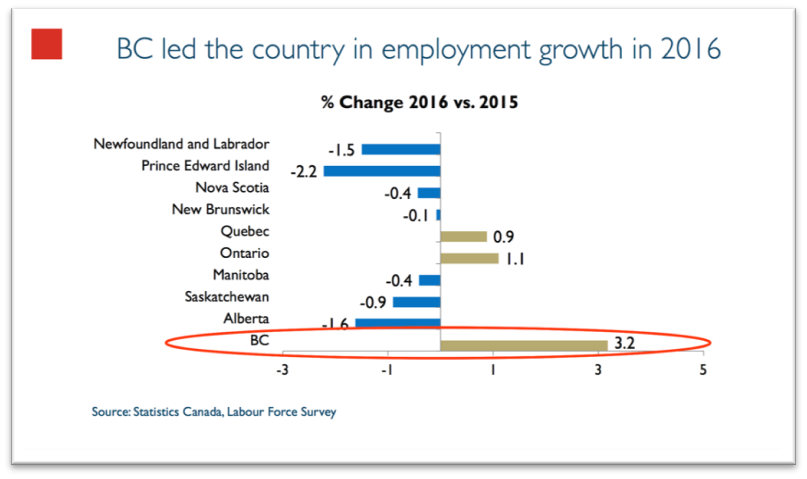

BC had the highest job growth in Canada at 3.2%.

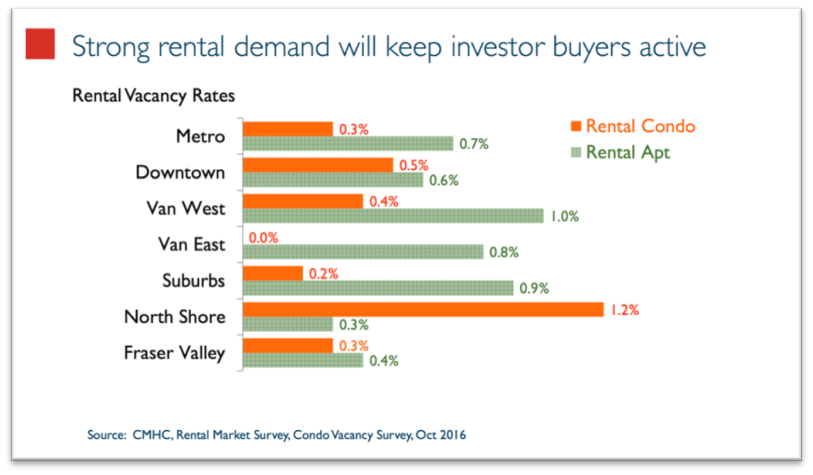

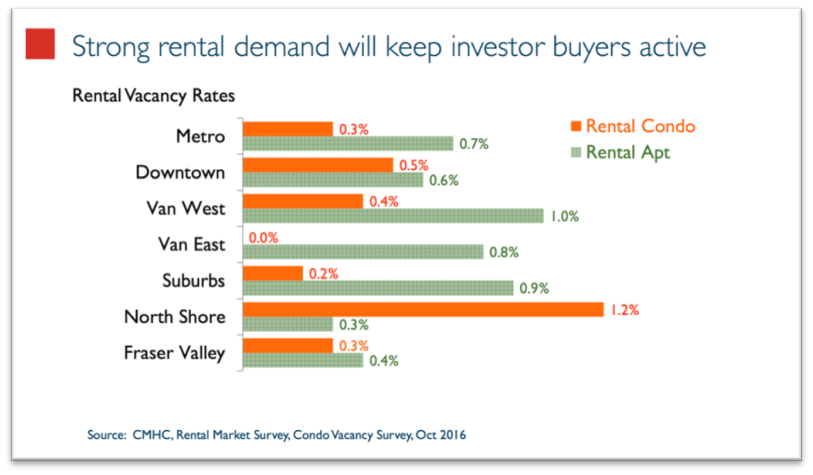

Most of BC has rental vacancies of less than 1%

This means that for every 100 properties that are rentals, only 1 or less than 1 is available to rent. This makes it easier for us to find and choose the best tenants.

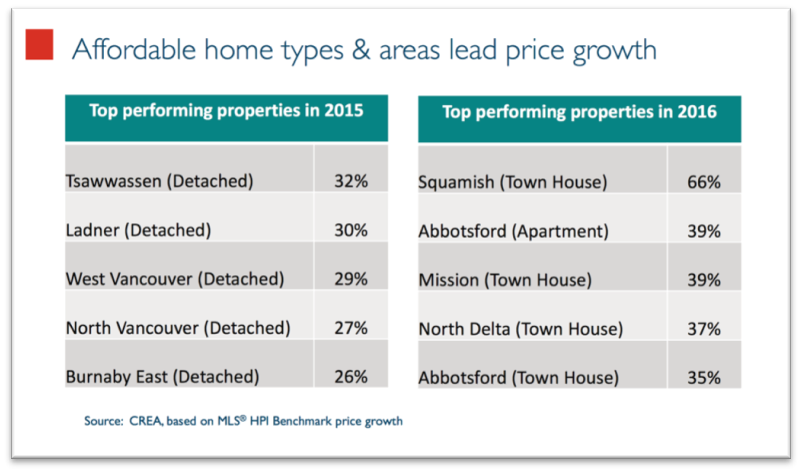

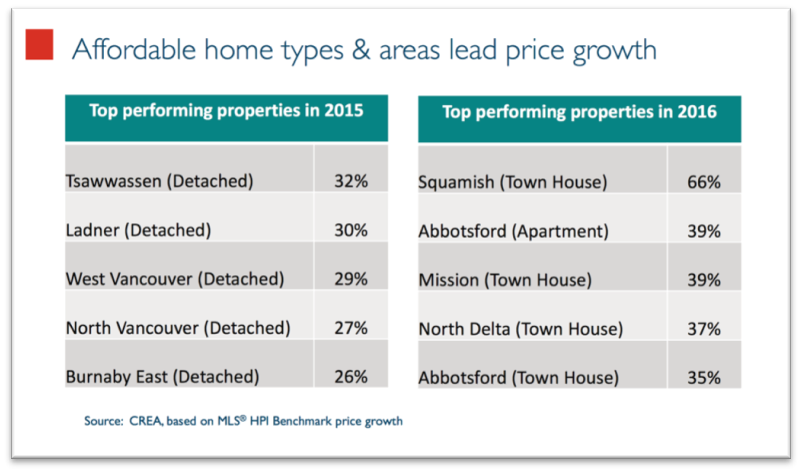

The most affordable homes in 2016 were in Squamish, Abbotsford, Mission and North Delta

Here at Point B Real Estate Investments, we focus mostly in Abbotsford. We find a higher quality tenant profile living there due to the various industries located in Abbotsford, like the University of the Fraser Valley, cancer research facility and rehab centre, and the Abbotsford Airport.

These are just a few things to consider before buying your next income property.

To view the full Futurecast presentation, click here.

And as always, if you have any questions about real estate investing or need help choosing your next income property, please contact us.

by Teresa Leung | Feb 9, 2017 | Blog, Real Estate Investing Tips

This post is by Point B Investment Team’s John Su. John specializes in joint ventures and investment properties. He helps clients invest in the Alberta and British Columbia markets to successfully purchase investment properties, and provides helpful landlord tips.

Many investors think that foreclosures are really great deals because they are paying substantially below market price for the property. But did you know that when you buy a foreclosed or bank-owned property, you cannot include any of the appliances like refrigerator, stove, microwave, or dishwasher with your offer?

This is because the bank doesn’t own those items. They only own the land and the house. I’ve heard of cases where the foreclosed owner even took the light fixtures, door handles and toilets with them in spite!

As the Buyer, you are purchasing the property “as is, where is”, with no warranty from the Seller. So there’s nothing you can do about it if any of the above are missing on your date of possession.

If you are the first person to submit an offer, you are able to put in subject clauses like inspection and financing and even negotiate on the price. Once the offer is accepted, it then goes to court. In court, anyone can bid on the property knowing what the accepted price is. The only caveat is the offer in court must be subject free. Therefore, it’s important to know the risks involved and to ensure financing is in place before making an offer in court.

What can investors do to analyze foreclosure deals?

To further demonstrate if foreclosures are indeed a good (or bad) deal, we’ve done an analysis of a foreclosed property sold to an investor. Based on our findings, and considering the adjustments, we found that the investor actually paid market value for the property. The investor may have even received a poorer asset because the comparable property had a river view and had newer renovations costing $10,000.

Click Here to View Analysis Example

So the next time you are looking at a foreclosed property, remember that you may not be getting the best deal. It may be better to find another property where you are able to the negotiate and price, terms, and inclusions. That way, once the offer is accepted, nobody else has the ability to grab it from under you!

You can always contact us here at Point B to help you evaluate whether the investment property you are considering, foreclosure or not, is a good deal.

by Teresa Leung | Oct 8, 2016 | Blog, Real Estate Investing Tips

If you are an investment newbie, you probably have a lot of questions in mind. What is real estate investment? Why should I invest my time in it? Is it worth investing my time? Where do I look? When do I start? How do I proceed?

To help clarify things, here is our guide for real estate investment newbies.

The “What”

What is real estate investment?

In the past week, I went around asking this question to some of my friends both in and out of the real estate field, and the responses I got were quite interesting.

“Oh you mean flipping a home?”

“I think it’s like buying a house and selling it for profit?”

“Buying a house…?”

“Buying a property and renting it out?”

The most surprising thing I found was that, no one was sure what real estate investment really means. They all sounded hesitant with their responses.

But the good news is that everyone was on the right track. Real estate investment involves investing in a real property for the purpose of making money. There are numerous ways to do this, some simple and some very complicated, so to simplify this for a newbie, I’ll just speak on the most commons methods to invest in real estate. Most people purchase property to either, 1) buy and hold to generate rental income, or 2) buy and flip or to sell to someone else when the market price goes up. But let’s be honest here, there is nothing wrong with doing both.

The “Why”

Why should I invest my time in it? Is it worth investing my time?

Passive income

As you may have guessed, the keyword here is passive income. Imagine earning supplementary income in your sleep – sounds too good to be true? It’s not. With the right properties and having other people manage the property for you, it is very possible for you to make money while you plan your upcoming vacation in Hawaii. But is the income really passive? Yes and no. Yes, if your property manager will treat your property like it’s their own, which is unlikely. Therefore, in the real world, most people will need to spend a little bit of time to manage the managers, and to keep track of what they are doing and if it is inline with your expectations.

Leveraging other people’s money

Yes, you read it correctly. Unlike daily commodities, you don’t need to pay the 100% cash for real estate. As this is a hard asset that the banks can take back in-case of defaulting on payments, they will lend you up to 80% of the purchase price in the form of a mortgage. If the investor chooses to use their home equity line of credit (HELOC) to finance the down payment and all starting costs, you can effectively leverage 100% of your property using the bank’s money. How cool is that!

Predictable Returns

When you do the math before you purchase, you will already know your estimated monthly expenses and income. As the years pass, it is likely that your property’s value is now worth more than when you purchased it. Essentially, this means that as your mortgage balance is going down, your home value is going up. Everything in between is the equity on the property that your tenants helped you get. What a beauty.

The “Where”

Where do I look?

Real estate investment will most likely be one of the most significant investments of your life, so it’s obvious that you want to put a lot of thought into it and make an educated decision on the location. Areas where there are job growth, population growth, and low vacancy rates is what we would recommend.

Check out the list of top British Columbia Investment Cities on our website at https://pointbinvestment.ca/where-to-invest/

The “When”

When do I start?

Assuming you have the money to invest, my honest answer to you is as soon as possible. Having said that, when do you know you’re ready?

Consider asking yourself these questions:

- Is your source of income secure enough for you to be making an investment?

- What are your priorities in life? Would real estate investment help you fulfill your goals?

- Are you able to set aside some time to connect yourself with resources that will help you get your first property? E.g. time to do research, time to meet with mortgage brokers and realtors who could help you with your investment, etc.

The “How”

How do I proceed?

Find a realtor who is also an investor him/herself. They will already know the best places and properties to invest in, thereby fast-tracking your learning. You also get the opportunity to leverage the knowledge and experience from the real estate investor’s team.

In addition, the team will be able to guide you through a wide range of considerations from conducting a cash flow analysis to supporting you through your concerns about the process of investing (and they could definitely relate because they’ve been in your shoes before).

You think you’re ready? Unsure? That’s okay! It’s never too early or too late to start investing in real estate. Contact Point B Investment Real Estate Team today by emailing us at success@pointBinvestment.ca to learn more about real estate investment and get advice from experienced professionals.

We look forward to hearing from you!

***Ask about our FREE Lunch ‘n Learn Seminars beginning in November 2016***

by Teresa Leung | Sep 19, 2016 | Blog, Real Estate Investing Tips

If the Vancouver real estate market has you wondering whether it’s even possible to earn your desired passive income, we have a few tips to share with our valued Investors and Investors-to-be to help you decide and invest with confidence.

Tip #1: Always do a cash flow analysis. Always.

Vancouver real estate is very expensive, so before you decide to commit to an investment, the most important thing to do is to conduct a cash flow analysis. No matter where you invest, whether here in Vancouver, or in another city, province, or country, a cash flow analysis of your real estate investment will help you make the most objective decision.

What does a cash flow analysis tell us?

To put it simply, a cash flow analysis will help you visualize if your projected income will cover all of your relevant expenses. Additionally, it will help put your emotions aside as it creates objectivity in your decision-making.

Our advice? Do research, do a cash flow analysis, and leave it to the numbers to help you make a decision like a real estate investor.

Tip #2: Never go into a bidding war not knowing your upper limit

It’s important to know at what price you will have to walk away from a deal, for several reasons. First, you may (unknowingly) get too emotional which could easily lead to overspending. Second, there is no point bidding for a property that may end up making your cash flow negative, defeating your purpose of investing. Third, you don’t want to buy at the height of the market. In real estate investing, you buy low and sell high, just like any other investment.

Tip #3: Furnish

Furnished properties generally make anywhere from $300 to $500 more on monthly rent than unfurnished ones. This is definitely true here in Vancouver, where the vacancy rate has declined to less than 1% as demand for rental spaces outpaced supply (Fall 2015 CMHC BC Rental Market Report).

The tenant profile for furnished rentals is generally business executives, or out-of-town short-term renters such as students and workers.

So why not take this opportunity and have some fun furnishing your investment property and make a little more money along the way?

Tip #4: Be Open-minded

Have you considered investing outside of Vancouver? Being open to investing in other areas in BC such as Burnaby, Surrey or Kelowna, may lead you to investments that produce a better ROI (Return on Investment).

Additionally, properties outside of Vancouver are often more affordable while still achieving similar rents. Essentially, you would be paying less for the property, but receive similar monthly rental income. For example, a three-bedroom condo in Kelowna is priced at $365,000 while a comparable unit in Vancouver scores at almost $1 million. Even if you receive higher rents in Vancouver, it may not be cash flow positive, especially with expenses such as property tax and strata fees to cover.

To give you a better idea, consider these two properties:

- A Kelowna 3-bedroom condo, price = $365,000, monthly rent = $2,500

- A Vancouver 3-bedroom condo, price = $905,000, monthly rent = $3,700

Annual rental yield of Kelowna condo = ($2,500 x 12) / $365,000 = 8.2%

Annual rental yield of Vancouver condo = ($3,700 x 12) / $905,000 = 4.9%

*Figures were obtained from real comparable properties.

As you can see, the Kelowna property produces a higher annual rental yield than that of a comparable property in Vancouver.

Tip #5: Investment Realtor = Investor

Always work with a realtor who is also an investor with their own real estate investment properties. They will be able to provide you with a comprehensive cash flow analysis and they will already know the types of property that will make money. Therefore, working with an investment realtor will save you time that you would spend doing the research yourself.

Experienced investment realtors also have connections that can benefit you. Oftentimes, they will have a team of investment specialists (e.g. mortgage brokers, property managers, accountant, lawyers/notaries, etc.) who are already familiar with investment properties. This way, you can leverage the skills and knowledge of the investment realtor’s team.

Want to learn more? Contact our team!

If you have read this until the end, then it’s a good idea to call our team for more information. It’s never too early to start investing. If you are here, then you know you are interested and you want to learn more.

You never know what you’ll find out. Contact Point B Investment Real Estate Team today by emailing us at success@pointBinvestment.ca.

We look forward to hearing from you.

by Teresa Leung | Sep 10, 2016 | Blog, Real Estate Investing Tips

There are many expenses that will pop up for landlords, even when you rent to good tenants. This is simply because having somebody living on a rental property comes with expenses: the dishwasher will break, the washing machine won’t work properly, etc. As such, you have to make sure that your rent properly matches the expenses and maintenance fees that are going to pop-up. As with everything in this world, that price is constantly increasing. So, that means that your rent should be as well.

Good Landlords Still Raise Rent

There are a lot of landlords out there who don’t want to raise the rent at all. It makes sense, seeing as many landlords feel that raising the rent is going to push away their loyal tenants, leaving terrible ones in their place. It’s an understandable fear, but you have to remember that the tenants who live in your building are humans, too. They understand that you’re raising the rent specifically for the purpose of making sure that the property is kept up-to-date for their benefit. Furthermore, there is a way to increase the rent in such a way so you won’t be that jerk landlord who randomly raises rent just because.

A major part of making sure that you are good landlord comes with following the law and the contract that both you and the tenant signed when the tenants moved in. A landlord is required in most situations to get 90 days notice when the rent is going to increase. As long as the landlord follows this, they are legally covered, but they’re also showing the tenant that they care about the people living on the rental property enough to notify them properly. It shows the tenant that the landlord is a good person and is simply raising the rent for practical reasons.

Additionally, the landlord is required to only raise rent a certain amount per year, usually somewhere around the line of 2%. So, while a landlord is not required to raise the rent every calendar year, it’s a good idea to consider it seriously, especially if you’re noticing more upkeep costs.

Good Living Means Mutual Respect

The price of living and enjoying life is climbing higher and higher every year, and the tenants that are living in your building understand that. As long as you follow the rules, you’re going to notice that nobody’s going to have a major problem. The good tenants – the ones who respect you as a person and a professional – are also comfortable coming to you if they have any concerns about the rent increase, and will also understand the reasons as to why (as mentioned already).

If you’re going into business for the first time as a landlord, and you’re looking for tips as to how to set the rent price, a lot of it comes down to simply how it appears to the prospective tenant that is touring the place. Since you’re limited by the laws in terms of how much you can increase, making sure that your first rental price is accurate and comfortable for you is extremely important.

If you’re leaning more towards the high market customers, which tend to be the ones that take better care of the property, make sure that you make the unit presentable to them in pictures, description, and presentation. Showing up to your meeting with them in a professional outfit shows them that you take your role seriously.

Make sure you come prepared to give them any information they need on the apartment in writing (much like real estate agents do with expenses, utilities, etc.). And make sure that the rental property itself is in perfect condition so that the tenant can see just how seriously you take the upkeep of the rental.

Pricing Strategy

Some first-time landlords make the mistake charging too low for rent in order to compete with all the other options out there. While it might make sense to be competitive, you have to make sure that you take that starting price very seriously. The price will determine how you do as a landlord, and how the tenant views your place. So make sure that the rent that you set covers enough for the upkeep of the rental property, plus extra. That way you will be paying for your business expenses from your business income, and won’t be paying out of your own pocket when it comes to maintenance.

As the years go by, it’s a good idea to increase the rent on regular basis, simply because the building/property is going to require much more maintenance as time goes on due to aging.

Be Professional

As you can see, a lot goes into making the financial decisions about your rental property. Always make sure you keep your competition in mind, and make sure that you’re matching them, but don’t try to outbid them, otherwise you’re only end up hurting yourself in the long run.

The realistic tenant understands that you have obligations to meet as well. And while they compare your price against the competition, they will also be looking for a good landlord who handles themselves professionally and does what is necessary to take care of the property and those living on it. How a landlord approaches the situation really does mean a lot to the tenant, so make sure you do things right for the start.

Don’t be afraid to increase the rent whenever you feel like expenses are climbing too high for the amount of money that you’re receiving from your loyal tenants. The good ones will stay, and the bad ones will leave.