In Part I of my article “Why Buying a Bosa Condo Won’t Make you Rich,” we saw how buying a property where expenses were higher than the rental income didn’t make financial sense.

In Part I of my article “Why Buying a Bosa Condo Won’t Make you Rich,” we saw how buying a property where expenses were higher than the rental income didn’t make financial sense.

Many of you commented on the opportunity cost of the down payment of $110,229 and how you can potentially earn 5-10% annually from investing in a ‘balanced portfolio’ with financial institutions instead.

Perhaps. But maybe you are saying this because you only know what you know and don’t realize what you don’t (yet) know.

I wrote the last article for two main reasons:

- 99% of so-called ‘Real Estate Investors’ don’t know what a true real estate investment is.

- making annual returns of 5-10% from investments is unacceptable, especially when your goal is true financial freedom.

Do you know what a true real estate investment is?

Many investors purchase based on emotions, speculating that the market will appreciate. Like the Bosa condo example in Part I, these people pour hundreds of dollars monthly into their property, and when the housing market crashes, these same Investors panic and sell their properties to avoid further losses. It’s sad for me to see this.

But it’s not really the consumer’s fault. According to Robert Shemin, US Investor and Instructor at Peak Potentials Real Estate Intensive, of all the active Realtors on the market, only 0.02% of them actually specialize in investment properties. And how can you tell if a Realtor is really an Investments Specialist? It’s actually quite easy. All Investment Realtors are also Investors themselves and will likely own multiple investment properties. But the sure-fire way of knowing if a Realtor really does specialize in Investments is by asking them to show you a pro-forma (cash flow analysis) of a property. If they look at you with a glazed look, it’s time to run. Having said that, it’s not the Realtor’s fault people buy ‘emotional investments’ either. Investment real estate isn’t part of the regular Realtor’s school curriculum.

What kind of annual return are you looking for?

I believe that making annual returns of 5-10% from investments is unacceptable and frankly just plain wrong. Trust me Mutual Fund Lovers, after I walk you through the numbers, you just may agree with me.

What does a true investment property look like? (Email me teresa@pointbinvestment.ca for a full report). You can only tell if a property is a true investment after analyzing the numbers, which most Investors and Realtors rarely do.

A true investment property will generate a monthly positive income (cash flow) after paying all the related expenses. This way, even when the market crashes, it wouldn’t affect the Investor at all IF they are not selling the property. Tenants still need a place to live in all market conditions and can’t arbitrarily lower the agreed upon monthly rent. In other words, a true investment property will protect its owner from housing market crashes.

A true investment property will also protect its owner from stock market crashes as it has no direct correlation with other investment vehicles.

Most importantly, a true real estate investment will make the owner money even when he or she is sleeping.

The sample property below is a 2-bedroom 2-bathroom resort-style condo that I sold just over a month ago in the Surrey area of Vancouver’s Fraser Valley. Now some of you may be reading this and think to yourself, “I don’t want to live in Surrey.” And that’s fine because this is an INVESTMENT, and you will likely NEVER live there. As savvy real estate investors, we invest where the numbers work in an area with exceptional economic fundamentals, which is not necessarily anywhere you may want to live in. Successful investors know that there are absolutely no emotions involved in choosing an investment property, as it’s really just a vehicle for income generation.

Now that we got emotions out of the way, let’s get to the fun part of analysing this property.

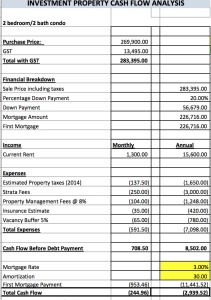

Property assumptions:

- List price of a 2 bed, 2 bath condo is $269,900

- From my Craigslist search the average monthly rent for a brand new quality, unfurnished 2 bed 2 bath condo in the Surrey area is $1,300

- 30 year amortization based on 3% interest rate

- 20% down payment

Unfortunately, the monthly cash flow is at negative $245 as an unfurnished suite, and this property loses almost $3000 annually.

But to be fair to the Bosa condo example, let’s compare apples to apples and see what happens when we furnish this baby and have it managed by a top property management company that specializes in vacation and corporate rentals.

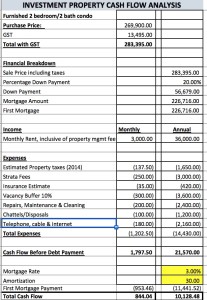

Using the same criteria as the Bosa Furnished suite example, here’s a reminder of the assumptions:

- $15,000 for furniture and chattels

- Monthly rental income inclusive of property management fees is $3000

- Vacancy buffer is now 10%

- Repairs, cleaning & maintenance is $200 per month

- Chattels & disposables would be $100 per month

- Telephone, cable & internet would be $180 per month

- All other assumptions remains the same as the unfurnished condo

O-M-G! This property now cash flows!!! But what does this mean exactly? Many of the readers from part one of this article mentioned opportunity cost, so let’s examine that. I’ve calculated the total start-up cost for this property to be $82,577, which consists of the down payment, property transfer tax, inspection, reserve funds of $5000, furniture, appraisal, legal and all miscellaneous advertising and closing costs. Since $82,577 is the total cash outlay, I will use this number to calculate this property’s return on investment.

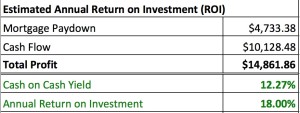

I’ve used the first year mortgage pay down and the annual positive cash flow as income, since mortgage pay down is pretty much a given and positive cash flow is likely going to happen based on the property being managed by experienced managers.

Return on Investment, ROI

As you can see, the initial investment of $82,577 provides a profit of almost $14,900 a year and an impressive 18% annual return on investment. Now when was the last time your investments gave you a predictable return of 18% per annum?

But wait, this gets better. Historically, real estate has doubled in value every 20 years; therefore, it wouldn’t be fair not to include capital appreciation into our analysis. I’ve used 3% appreciation per year just to keep up with inflation, but in some markets such as Fort St. John, BC, and Calgary, Alberta and in some parts of Asia, the capital growth in recent years had been much higher. Based on this assumption, below is an illustration of what would happen to this property in five years.

5 Year ROI

I don’t know about you, but I sure don’t mind making this type of return for doing… well…nothing. Let me explain. We spent $82,577 on the property, we didn’t do a thing after the initial purchase as it’s managed by someone else, and we made over $120,000 in 5 years or 146% ROI. No wonder you always hear of people making millions with real estate. They get this!

Now if real estate investing can provide consumers with such amazing returns, why isn’t everyone and their dog jumping in to invest? Like I said earlier, only 0.02% of Realtors understand investment real estate. Banks and financial advisors don’t sell real estate and it’s the financial institutions that have the multi-million dollar marketing budgets.

This comes to the third reason why I wrote this two-part article. It’s so you, my readers, can join the 1% of Investors out there who do know what a true real estate investment is. It’s so that you can start creating wealth and time freedom today.

So I’m going to ask you the same question I asked in Part I of this article, “For the rest of your life, would you rather make money in your sleep, or work actively for your money trading dollars for hours?” I chose the former. Now you can too!

If you found this article helpful in any way, please share this with your friends and loved ones so that they too, can benefit from this information.

Teresa Leung is an Investments Realtor specializing in finding cash-flowing properties in areas with outstanding economic fundamentals, and creating turn-key investments for people who prefer to invest passively. She’s a Mentor with University of BC’s Sauder School of Business, Community Council Member of Salvation Army’s Kate Booth House, Co-founder of Exceptional Lifestyle Addicts Meetup and former Director of Marketing & Investor Relations with Award-winning Real Estate Investment Firm, Alture Properties. You can find her on twitter @TeresaInvestor. For more information, e-mail Teresa at teresa

Disclaimer: The average annualized capital appreciation on Canadian real estate is above 5.0% per annum since 1980 and 3% scenarios have been used for illustrative purposes only.

E. & O. E. The calculations and assumptions listed above are estimates only, they are not guaranteed., and in no way reflect with absolute certainty the future performance of the property. Purchasers are responsible for performing their own evaluation and forecasts. As with all real estate purchases, actuals may vary due to current and future economic conditions and time. Projections are for illustrative purposes only and are not indicative of anyactual returns or a guarantee thereof. Accordingly, there is no representation that actual results realized will be the same, in whole or in part, as those presented herein. Vacancy rates, inflation rates, appreciation rates, and mortgage rates are subject to market conditions.