I had the pleasure of meeting Jim Bosa, President of Appia Developments, at the Realtor’s launch of Phase II of their North Burnaby Solo District project last month. Appia Developments are one of North America’s premier property development firms within the popular Bosa Group of Companies.

For someone with enormous wealth and success, Jim Bosa is truly an understated gentleman who came across as humble and even a bit shy. He mentioned that he didn’t usually speak at public events, and he graciously agreed to answer a few questions and take a photo for my blog (yes, he really is tall, and I am really this short).

I asked Jim if he thought his condos would make a good investment and he said, “It depends on what you are looking for, but I welcome all purchasers whether they are home owners or investors.” Smart answer. The rest of our conversation was just chatting about the future of North Burnaby and how his company plans to capitalize on the area’s growth.

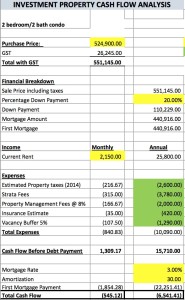

Before I left the event, I grabbed a price list to determine for myself if buying a brand new condo from Solo District would be a good investment based on cash flow. After all, I am a Real Estate Investor and I’m always looking for good investments. After analysing the numbers, here are my results based on the following assumptions:

- List price of a 2 bed, 2 bath condo is $551,145 inclusive of GST

- From my Craigslist search the average rental price for a brand new quality, unfurnished 2 bed 2 bath condo in the North Burnaby area is $2150

- 30 year amortization based on 3% interest rate

- 20% down payment

Unfortunately, the monthly cash flow is at negative $545 and this property loses $6542 each year.

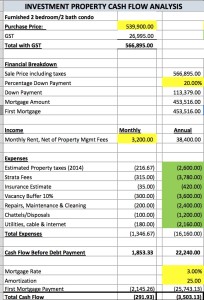

But I really like Jim Bosa, and I want to buy his condo as an investment, so I’m going to increase the monthly income by renting this as a furnished condo, managed by a top property management company with higher profile tenants. By the way, most of the time, when renting out a furnished property, not only do you buy the furniture and chattels, you are also responsible to pay for the utilities since it’s mostly short-term renters. Here are the new assumptions:

- Add $15,000 for furniture and chattels (for simplicity sake, I added this to the purchase price and mortgage)

- Monthly rental income inclusive of property management fees is $3000

- Vacancy buffer is now 10% as furnished can be harder to rent for a full year (unfurnished would be 5%)

- Repairs, cleaning & maintenance is $200 per month

- Chattels & disposables would be $100 per month

- Utilities, cable & internet would be $180 per month

- All other assumptions remains the same as non-furnished condo

Let’s see what we get with this new scenario.

Damn, even when furnished, the cash flow is still negative $254 per month with losses of over $3000 annually.

What can I say Jim? As savvy Real Estate Investors, we always invest for positive cash flow first, as opposed to capital growth/appreciation. Therefore, as much as I like you, the North Burnaby area, and the Solo District project, buying a brand new Bosa condo will not get me rich. I’m not just picking on Appia or Bosa, as the same would be true for a brand new condo with Concord Pacific, Wall Centre, Polygon or any developer if rents don’t cover expenses. It’s that simple. The key is to treat your real estate investments like a business and if the projected rents cannot cover all the related expenses, it’s like buying a company that loses money each month. It doesn’t make financial sense.

Now don’t get me wrong, many people look at these new condos as emotional investments similar to buying a brand new Jaguar or Porsche. They’ll never get rich from the purchase, but it sure as hell makes them feel fantastic when they’re in it.

The magic question to ask before investing is, “Are you a Business Owner or an Emotional Investor?” Or better yet, “For the rest of your life, would you rather make money in your sleep or work actively for your money trading dollars for hours?” I choose the former. How about you?

Click here to read Part II of this article.

Teresa Leung is an Investments Realtor specializing in finding cash-flowing properties in areas with outstanding economic fundamentals, and creating turn-key investments for people who prefer to invest passively. She’s a Mentor with University of BC’s Sauder School of Business, Community Council Member of Salvation Army’s Kate Booth House, Co-founder of Exceptional Lifestyle Addicts Meetup and former Director of Marketing & Investor Relations with Award-winning Real Estate Investment Firm, Alture Properties. You can find her on twitter @TeresaInvestor. For more information, e-mail Teresa at teresa