by Teresa Leung | Dec 7, 2017 | Real Estate Investing Tips, Uncategorized

In October 2017, the Bank of Canada announced that new mortgage rules will be taking place beginning Jan 1, 2018. This will drastically affect borrowers if they are currently putting a minimum of 20% towards their down payment as of right now as they are enjoying the benefits of qualifying for the lower rate of their mortgage contract. As of next year, it will become mandatory for borrowers to qualify for a greater benchmark rate either at 4.99% or their contact rate with an additional two percent on top – therefore reducing the amount you can borrow by around 20%.

For example, if buyers currently qualify to be a in fixed term mortgage contract at a discounted rate of 3.14%, under the new rules they would have to add an additional 2%, thereby, they would have to qualify at a rate of 5.14%.

Borrowers however may be able to be exempt from the new mortgage rules should they either:

- renew their current mortgage with their existing lender where their amortization period stay the same and where no additional funds advance;

- if they purchase a property before the new rules take into effect (completion can be in the new year);

- if they get a mortgage with credit unions such as Coast Capital or Vancity due to the fact that they are not federally regulated banks, and as of this writing, only federally regulated banks are affected by this new rule.

With that being said, it is important that as real estate investors you understand how the new mortgage rules taking place will affect you so you can prepare for any changes ahead of time. Happy mortgage shopping!

by Teresa Leung | Nov 24, 2017 | Blog, Real Estate Investing Tips

The City of Vancouver is implementing an Empty Homes Tax due to a lack of rental properties available. Properties deemed vacant will be subject to a tax of 1% of the property’s assessed taxable value.

Mayor Gregor Robertson said,“Vancouver renters are in crisis, with the rental vacancy rate hovering over zero for years. The city will not sit on the sidelines as more than 25,000 empty and under-occupied properties hold back homes for people who live and work in Vancouver. We need a tax on empty homes to encourage the best use of all our housing, and help boost our rental supply for locals.”

Consequently, it will now be mandatory for each Vancouver homeowner in the city to submit a declaration of their annual property status – determining if their property will be subjected to the empty homes tax policy by February 2, 2018.

Most properties will not be subject to the Empty Homes Tax, including those:

- Used as a principal residence by the owner, his/her family member, or a friend for at least six months of the current year

- Rented for at least six months of the current year, in periods of 30 or more consecutive days

- Meeting the criteria for one of the exemptions https://rem.ax/2B0AbH4 .

Nonetheless, upon failure of submission or meeting any of the exemption criteria, your property will be reckoned as vacant and will be subject to the one percent tax rate based on the 2017 assessed taxable value of the property. This is sure to impact the vacancy of homes as based on the assessed value of an average home in Vancouver now to be $1 million the tax subjection would cost owners at least $10,000.

In addition to this, the homeowner will also be charged with a $250 penalty for not adhering to the declaration requirements.

As Real Estate Investors, we’re sure your Vancouver home will be full of tenants at all times, but we just thought we would give you this interesting update. Happy Landlording!

by Teresa Leung | May 6, 2017 | Blog, Real Estate Investing Tips

One of the most frequent questions my clients ask is, “Should I incorporate or use my personal name to invest?” There is no hard and fast answer for this, as everyone has different circumstances.

As an Investor myself, and someone who has helped hundreds of investors purchase their real estate, all I can tell you is that about 90% of my clients, even the wealthy ones with over 10 investment properties, have invested in their personal names.

Drawbacks of Incorporating

Of the 10% who invest through their corporation, there are a few who wished that they had just invested in their personal names. When I ask those clients why they regretted investing through their corporations, this is what they have told me:

Difficult Mortgage Approvals

“Mortgage financing became harder as only a handful of banks will finance an investment property owned by a corporation. It also takes longer to get the approval, and there pages upon pages of criteria for us to fulfill. We were nervous that we would lose the deal because we couldn’t remove subjects.”

Additional Fees

“The start-up costs of a corporation and the annual accounting and filing fees are a few thousand dollars. That eats up all our positive cash-flow on our properties.”

High Taxes

“I was told by my accountant that taxes for rental income is over 49% as the exemption only applies if I have 5 or more full-time employees in my real estate business.”

Ouch!!!

For the above three reasons alone, I can see why so many people shy away from incorporating. Having said that, there are benefits to incorporating too.

Benefits of Incorporating

For investors who do joint ventures and have many partners, investing via a corporation can add a layer of protection in the event of a legal dispute. Owners of a corporation wouldn’t likely be impacted by any remedy or judgement.

Upon hearing this, investors usually follow up with, “What about tenants suing me?”

If your property is managed by a property management company, they should have insurance to cover liability claims. You should also have tenant insurance on your home insurance policy, and make sure that it includes liability coverage. It’s always best to check with your property manager and your home insurance company to know what you are covered for.

It’s also wise to keep your investment property in good shape and do repairs as soon as possible after the tenant reports it to you. That way, you will avoid most tenant claims for injury.

Assess Your Situation to Decide What’s Best for You

In general, if you plan on investing in under 5 income properties, its probably better to invest in your personal name. But if you plan on making real estate investing your business and invest in many properties with various partners, then having a corporation could be beneficial for liability reasons.

I invest in both my personal name and through a corporation. For my joint venture deals, it’s through my corporation. When investing on my own or with my family, I invest in my personal name. That’s the best scenario for me.

If you have any other questions regarding this topic, it would be best to speak to your real estate lawyer. They can determine what is the best scenario for you.

by Teresa Leung | Mar 11, 2017 | Blog

As investors, one of the first things we should look into when choosing where to purchase income properties is the economic fundamentals of an area. Does the area have a strong population growth? How is the job growth in the region? Are vacancy rates high or low?

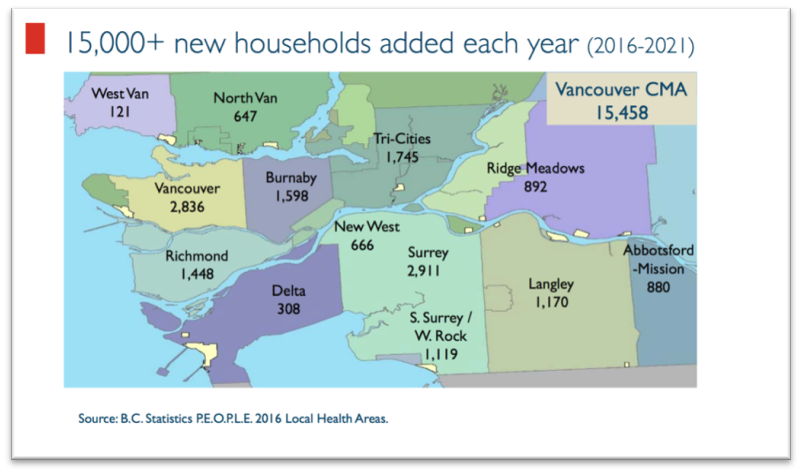

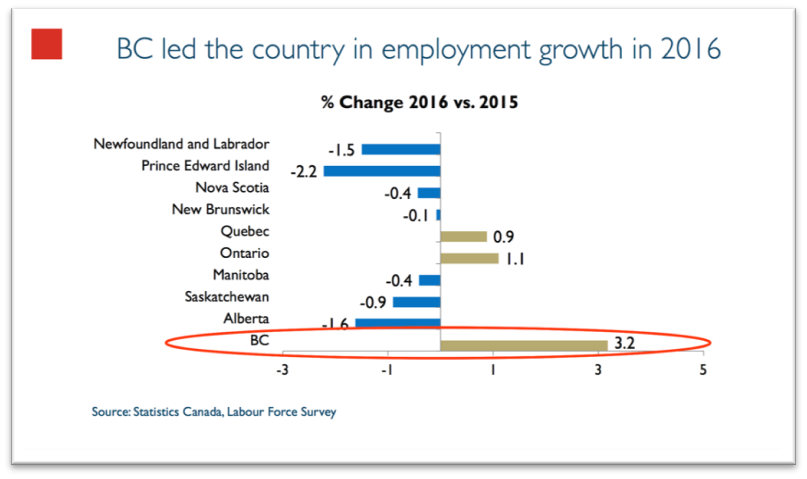

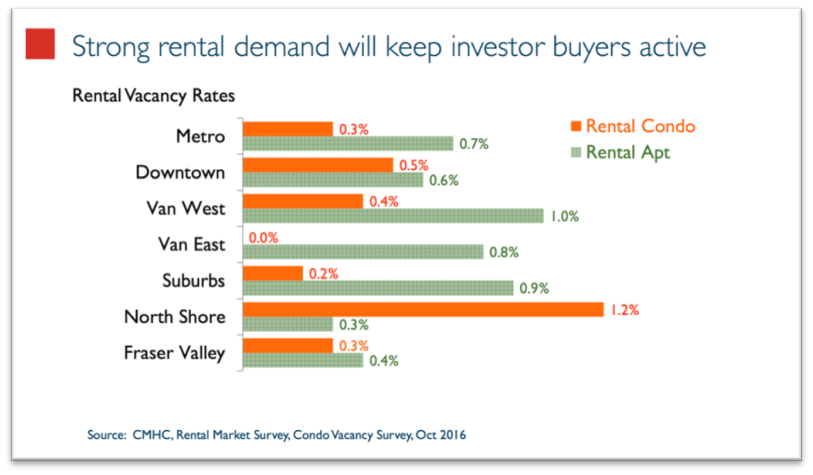

BC currently shows a strong population growth, job growth and low vacancy rate. Here are some excerpts from the CHMC Vancouver Housing Update and Urban Analytics Futurecast presentations which we can use to determine where to purchase next.

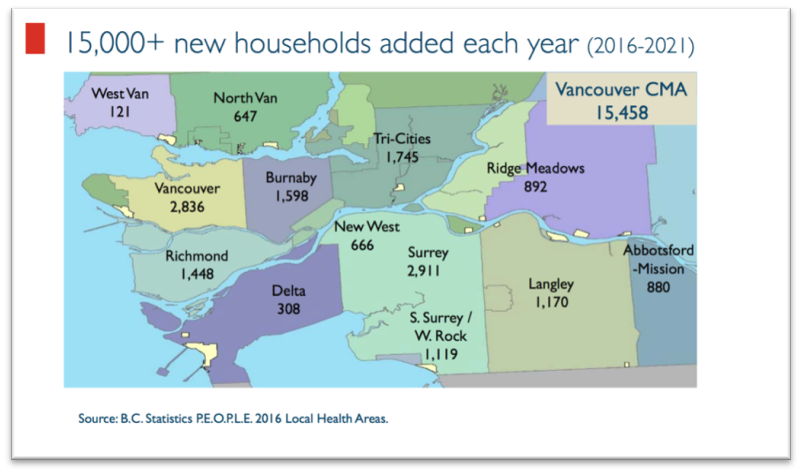

Surrey lead BC’s population growth, adding 4000 households, while Vancouver was second with 2836 new households.

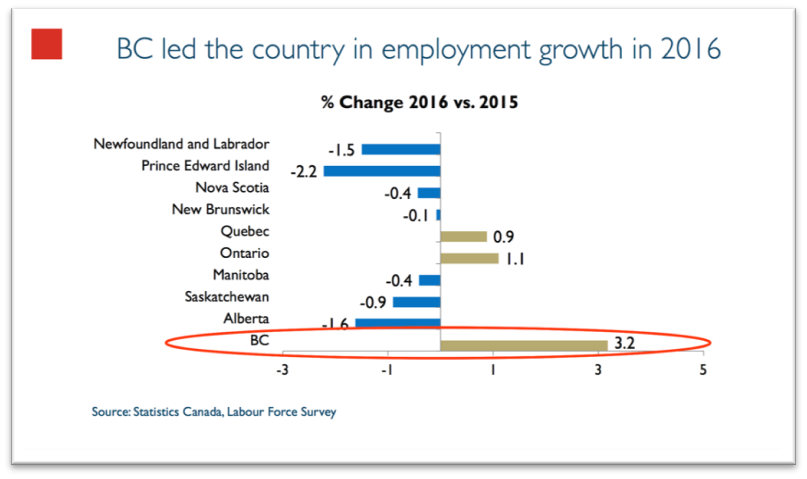

BC had the highest job growth in Canada at 3.2%.

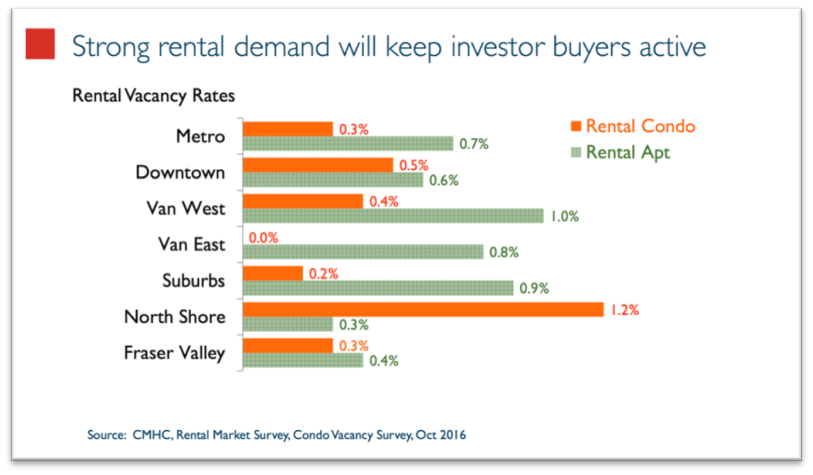

Most of BC has rental vacancies of less than 1%

This means that for every 100 properties that are rentals, only 1 or less than 1 is available to rent. This makes it easier for us to find and choose the best tenants.

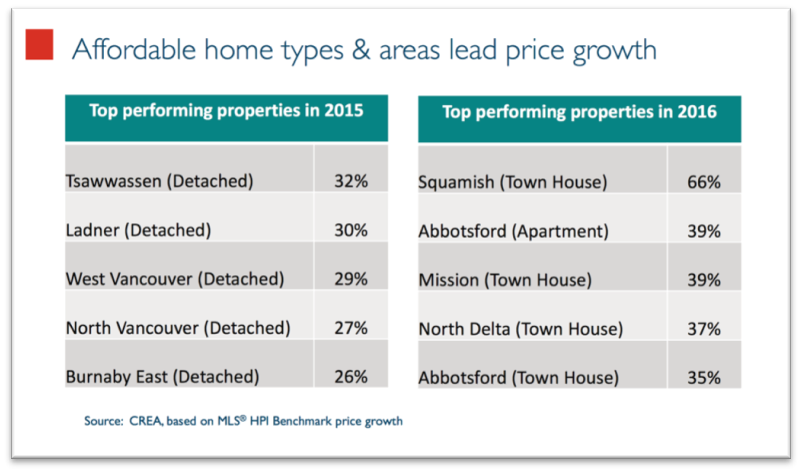

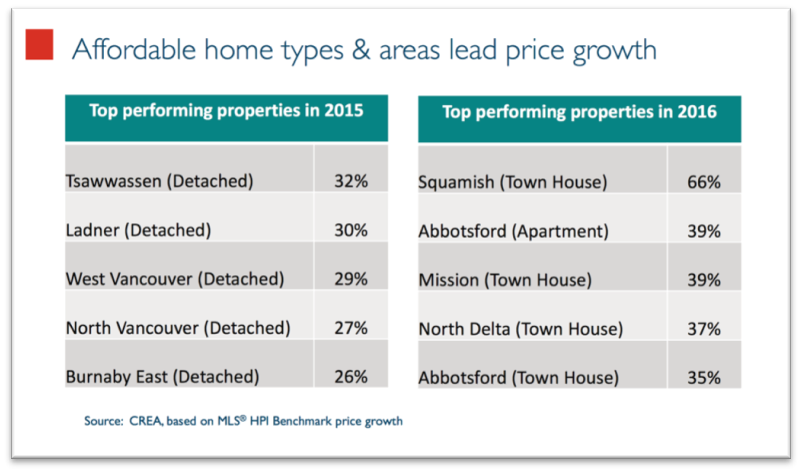

The most affordable homes in 2016 were in Squamish, Abbotsford, Mission and North Delta

Here at Point B Real Estate Investments, we focus mostly in Abbotsford. We find a higher quality tenant profile living there due to the various industries located in Abbotsford, like the University of the Fraser Valley, cancer research facility and rehab centre, and the Abbotsford Airport.

These are just a few things to consider before buying your next income property.

To view the full Futurecast presentation, click here.

And as always, if you have any questions about real estate investing or need help choosing your next income property, please contact us.

by Teresa Leung | Feb 9, 2017 | Blog, Real Estate Investing Tips

This post is by Point B Investment Team’s John Su. John specializes in joint ventures and investment properties. He helps clients invest in the Alberta and British Columbia markets to successfully purchase investment properties, and provides helpful landlord tips.

Many investors think that foreclosures are really great deals because they are paying substantially below market price for the property. But did you know that when you buy a foreclosed or bank-owned property, you cannot include any of the appliances like refrigerator, stove, microwave, or dishwasher with your offer?

This is because the bank doesn’t own those items. They only own the land and the house. I’ve heard of cases where the foreclosed owner even took the light fixtures, door handles and toilets with them in spite!

As the Buyer, you are purchasing the property “as is, where is”, with no warranty from the Seller. So there’s nothing you can do about it if any of the above are missing on your date of possession.

If you are the first person to submit an offer, you are able to put in subject clauses like inspection and financing and even negotiate on the price. Once the offer is accepted, it then goes to court. In court, anyone can bid on the property knowing what the accepted price is. The only caveat is the offer in court must be subject free. Therefore, it’s important to know the risks involved and to ensure financing is in place before making an offer in court.

What can investors do to analyze foreclosure deals?

To further demonstrate if foreclosures are indeed a good (or bad) deal, we’ve done an analysis of a foreclosed property sold to an investor. Based on our findings, and considering the adjustments, we found that the investor actually paid market value for the property. The investor may have even received a poorer asset because the comparable property had a river view and had newer renovations costing $10,000.

Click Here to View Analysis Example

So the next time you are looking at a foreclosed property, remember that you may not be getting the best deal. It may be better to find another property where you are able to the negotiate and price, terms, and inclusions. That way, once the offer is accepted, nobody else has the ability to grab it from under you!

You can always contact us here at Point B to help you evaluate whether the investment property you are considering, foreclosure or not, is a good deal.

by Teresa Leung | Oct 8, 2016 | Blog, Real Estate Investing Tips

If you are an investment newbie, you probably have a lot of questions in mind. What is real estate investment? Why should I invest my time in it? Is it worth investing my time? Where do I look? When do I start? How do I proceed?

To help clarify things, here is our guide for real estate investment newbies.

The “What”

What is real estate investment?

In the past week, I went around asking this question to some of my friends both in and out of the real estate field, and the responses I got were quite interesting.

“Oh you mean flipping a home?”

“I think it’s like buying a house and selling it for profit?”

“Buying a house…?”

“Buying a property and renting it out?”

The most surprising thing I found was that, no one was sure what real estate investment really means. They all sounded hesitant with their responses.

But the good news is that everyone was on the right track. Real estate investment involves investing in a real property for the purpose of making money. There are numerous ways to do this, some simple and some very complicated, so to simplify this for a newbie, I’ll just speak on the most commons methods to invest in real estate. Most people purchase property to either, 1) buy and hold to generate rental income, or 2) buy and flip or to sell to someone else when the market price goes up. But let’s be honest here, there is nothing wrong with doing both.

The “Why”

Why should I invest my time in it? Is it worth investing my time?

Passive income

As you may have guessed, the keyword here is passive income. Imagine earning supplementary income in your sleep – sounds too good to be true? It’s not. With the right properties and having other people manage the property for you, it is very possible for you to make money while you plan your upcoming vacation in Hawaii. But is the income really passive? Yes and no. Yes, if your property manager will treat your property like it’s their own, which is unlikely. Therefore, in the real world, most people will need to spend a little bit of time to manage the managers, and to keep track of what they are doing and if it is inline with your expectations.

Leveraging other people’s money

Yes, you read it correctly. Unlike daily commodities, you don’t need to pay the 100% cash for real estate. As this is a hard asset that the banks can take back in-case of defaulting on payments, they will lend you up to 80% of the purchase price in the form of a mortgage. If the investor chooses to use their home equity line of credit (HELOC) to finance the down payment and all starting costs, you can effectively leverage 100% of your property using the bank’s money. How cool is that!

Predictable Returns

When you do the math before you purchase, you will already know your estimated monthly expenses and income. As the years pass, it is likely that your property’s value is now worth more than when you purchased it. Essentially, this means that as your mortgage balance is going down, your home value is going up. Everything in between is the equity on the property that your tenants helped you get. What a beauty.

The “Where”

Where do I look?

Real estate investment will most likely be one of the most significant investments of your life, so it’s obvious that you want to put a lot of thought into it and make an educated decision on the location. Areas where there are job growth, population growth, and low vacancy rates is what we would recommend.

Check out the list of top British Columbia Investment Cities on our website at https://pointbinvestment.ca/where-to-invest/

The “When”

When do I start?

Assuming you have the money to invest, my honest answer to you is as soon as possible. Having said that, when do you know you’re ready?

Consider asking yourself these questions:

- Is your source of income secure enough for you to be making an investment?

- What are your priorities in life? Would real estate investment help you fulfill your goals?

- Are you able to set aside some time to connect yourself with resources that will help you get your first property? E.g. time to do research, time to meet with mortgage brokers and realtors who could help you with your investment, etc.

The “How”

How do I proceed?

Find a realtor who is also an investor him/herself. They will already know the best places and properties to invest in, thereby fast-tracking your learning. You also get the opportunity to leverage the knowledge and experience from the real estate investor’s team.

In addition, the team will be able to guide you through a wide range of considerations from conducting a cash flow analysis to supporting you through your concerns about the process of investing (and they could definitely relate because they’ve been in your shoes before).

You think you’re ready? Unsure? That’s okay! It’s never too early or too late to start investing in real estate. Contact Point B Investment Real Estate Team today by emailing us at success@pointBinvestment.ca to learn more about real estate investment and get advice from experienced professionals.

We look forward to hearing from you!

***Ask about our FREE Lunch ‘n Learn Seminars beginning in November 2016***